Lawyer Debt Collection Letter: Templates + Best Practices

What is a Lawyer Debt Collection Letter?

In the legal business, a debt collection letter informs clients about their unpaid bills. The letter also includes instructions for settling their debt (upfront or through a repayment program) and information on the potential legal action if the client fails to pay.

Why and When to Use Debt Collection Letters

The debt collection process is a touchy subject, and most lawyers definitely don’t relish writing demand letters. But, as a growing law firm, they will become a necessity.

Below are the top reasons why:

Your Client is Financially Incapable of Paying

Just because a client failed to settle their due bills on time, doesn’t mean they don’t want to.

It’s reasonable to think that your client found themself in a tough financial spot, especially considering the cost of legal services. As such, your lawyer debt collection letter may offer a repayment plan that allows incremental payment, including interest.

Remember, your client genuinely might not have the resources to pay their debt in full.

Accepting payment via installments may not be preferable for your law firm, but they’re far better than getting no payments at all.

Your Client Simply Forgot or Couldn’t Find the Time to Process Their Payment

In a fast-paced world, it’s understandable for people to put uncomfortable tasks — like taking thousands of dollars from their bank accounts — on hold.

There’s also the off-chance that their legal bills slipped your client’s mind.

In both situations, a formal debt collection letter should set things straight. It provides a gentle reminder for clients to pay their debt while avoiding legal action and maintaining a positive relationship with your firm.

Your Client Wants to Renegotiate Their Debt

If your client is late on their payment, they might be thinking of renegotiating their legal bill.

In this case, a debt collection letter initiates a dialogue wherein you can find mutually beneficial grounds.

For instance, an installment plan means it will take longer to receive what you’re owed in full. But you could end up receiving more through interest and late payment fees.

A renegotiation will also improve your client relationship, which can also lead to more referral clients in the long run.

The Client Flat Out Refuses to Pay

Unfortunately, negotiations can go sour at any point — and there are people who are willing to risk getting legal action taken against them to avoid paying debts.

Sending such clients a debt collection letter is the professional thing to do. It offers them one last opportunity to change their mind and sends a fair warning should they willingly choose to go this route.

A debt collection letter also serves as hard evidence that you gave your client an ample chance to settle their dues — should you hire a debt collection agency or file a lawsuit.

Parts of a Debt Collection Letter: 8 Details

Now that you know the reasons to send debt collection letters, it’s time to learn how to write them.

Here’s a tip: Use the elements below to put together an optimized, reusable template and design an automated workflow around it.

Without further ado, below are eight important details that every debt collection letter should include:

1. Clear Subhead

In a debt collection letter, the subhead contains the details of both your law firm and your client.

This includes:

- Your law firm’s name

- Your full name

- Your office address, zip code, and contact number

- The client’s full name and address

- The date

To make the subhead as clear and readable as possible, use one line for each piece of information. You can also space out the lines to make the subhead more scannable.

2. Debt Details

After the subhead, get straight to the point and mention the unpaid invoice.

Include the unpaid amount and the invoice due date. It’s also important to mention the number of days the invoice is overdue to give your client a better grasp of the problem.

3. Amount Owed

If your agreement includes an interest charge for late payments, the original invoice amount may not equal the amount owed.

Be as transparent as possible and share a detailed breakdown of the additional fees. Directly comparing the original amount and the current amount owed instills a sense of urgency, which may compel clients to settle their debt ASAP.

4. Additional Context

The next must-have ingredient of your debt collection letter is additional context to prevent any confusion.

You already mentioned the unpaid amount, the missed due date, and the interest charge. In chronological order, you can slide in some more information about the legal services rendered and when they were completed.

5. Payment Instructions

After making sure you and your client are on the same page, it’s time to show them the next steps.

Feel free to specify new terms, like a minimum required payment amount or additional payment channels in case they’re unable to use the payment method from the original contract. Be sure to include your payment details, such as your bank account number or a LawPay link.

6. New Deadline

Encourage your client to take action by setting a new deadline for their debt settlement.

Try to provide a reasonable timeframe, such as 30 days tops, to enable your client to acquire enough funds or ponder over other payment options. Factor in the time before the client actually reads your letter upon receipt.

7. Offer Assistance

At this point, your client is probably feeling some pressure, which can influence the way they react to your debt collection letter.

That’s why it’s important to offer assistance and mention other actions they can take before settling their debt. For example, let them know that they can respond to your letter in case they have questions — or if they think there are mistakes in your calculations.

You may also offer assistance by attaching or linking to your original contract and other useful resources that can help with their payment.

8. Prompt Caution

Lastly, let your client know that there are consequences should they fail to fulfill their obligations on time. Mention the additional interest charges they might accumulate or the potential legal action you can take against them.

Best Practices for Writing a Debt Collection Letter

Writing debt collection letters is like walking on thin ice. It can escalate into something tense or result in you receiving what you’re owed.

To maximize your chances of getting positive results, remember the following best practices to remember:

- Don’t use hostile language. Most times, clients are unable to pay their legal bills for a good reason. Using hostile or threatening language in your debt collection letter only makes matters worse and will surely stain your brand image.

- Be transparent. Never obscure facts or calculations about your client’s debt. If you want them to pay your invoice, you need to provide them with the full details of the situation.

- Provide a reasonable timeline for action. Use your judgment to decide on a reasonable timeline for a full or incremental payment. Don’t expect your client to rummage out thousands of dollars within ours or anything less than a week.

- Be open to communication. Openly invite your client to respond and start a discussion to find a common ground. They might come up with an entirely different arrangement that leads to bigger benefits for your firm.

- Stay professional. Debt collection letters are opportunities for your firm to showcase your utmost professionalism. Be respectful and use words like “thank you,” “please,” and “we’re always here to help.”

4 Debt Collection Lawyer Templates You Can Use

No time to draw up a debt collection letter from scratch?

Here are four ready-to-use debt collection letter templates for legal service providers:

1. One-time Debt Collection Letter

Feel free to copy and paste the following template. Just fill in the missing information and you’re good to go!

[Your name]

[Your firm’s name]

[Your firm’s address and zip code]

[Your firm’s contact information]

[The client’s name]

[The client’s address and zip code]

[The date]

Dear [client],

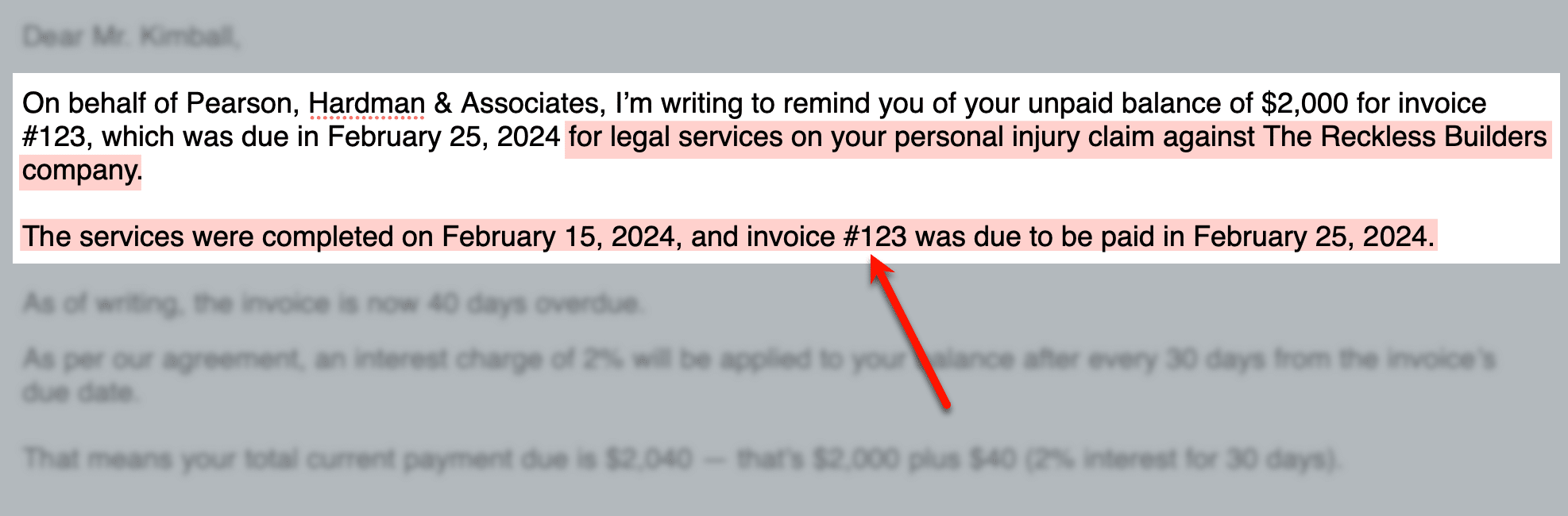

On behalf of [law firm], I’m writing to remind you of your unpaid balance of [debt amount] for invoice [invoice number], which was due in [original due date] for legal services on your [case details].

The services were completed on [service completion date], and invoice [invoice number] was due to be paid in [original due date].

As of writing, the invoice is now [X] days overdue.

As per our agreement, an interest charge of [interest rate] will be applied to your balance every [X] days from the invoice’s due date.

That means your total current payment due is [new amount owed] — that’s [debt amount] plus [interest charge] (X interest for X days).

You can send your payment using the following details:

Bank Name: [bank name]

Account: [account holder’s name]

Account Number: XXXXXXXXXXXXXXX

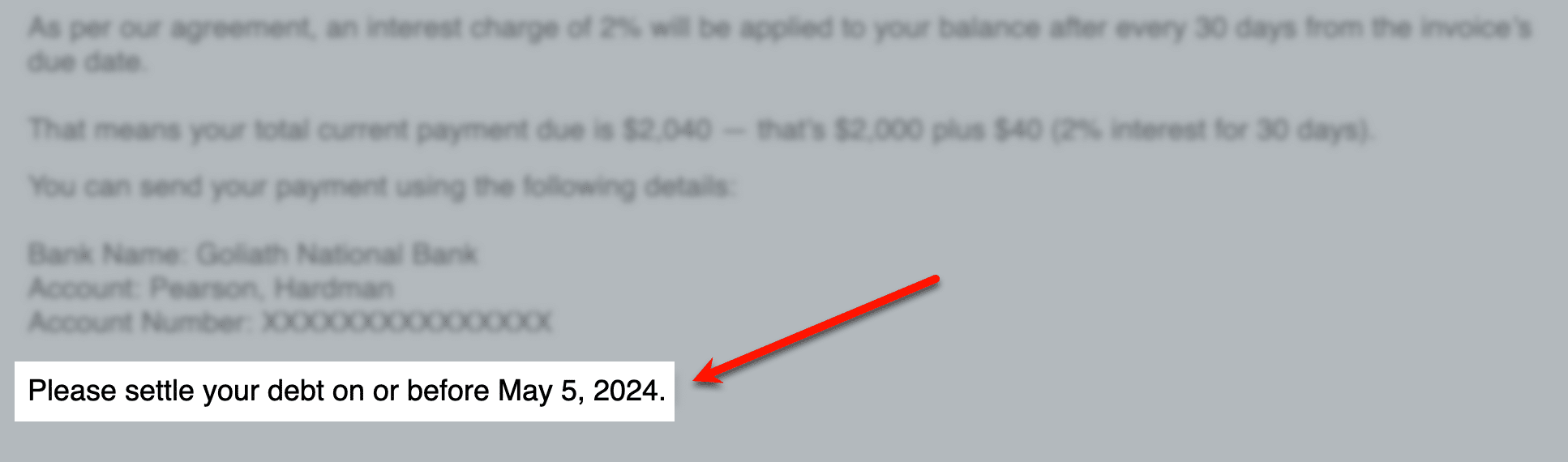

Please settle your debt on or before [new deadline].

If you think there is a mistake with your invoice, or if you’re having trouble paying the full amount at this time, feel free to respond to this email to discuss alternative payment arrangements.

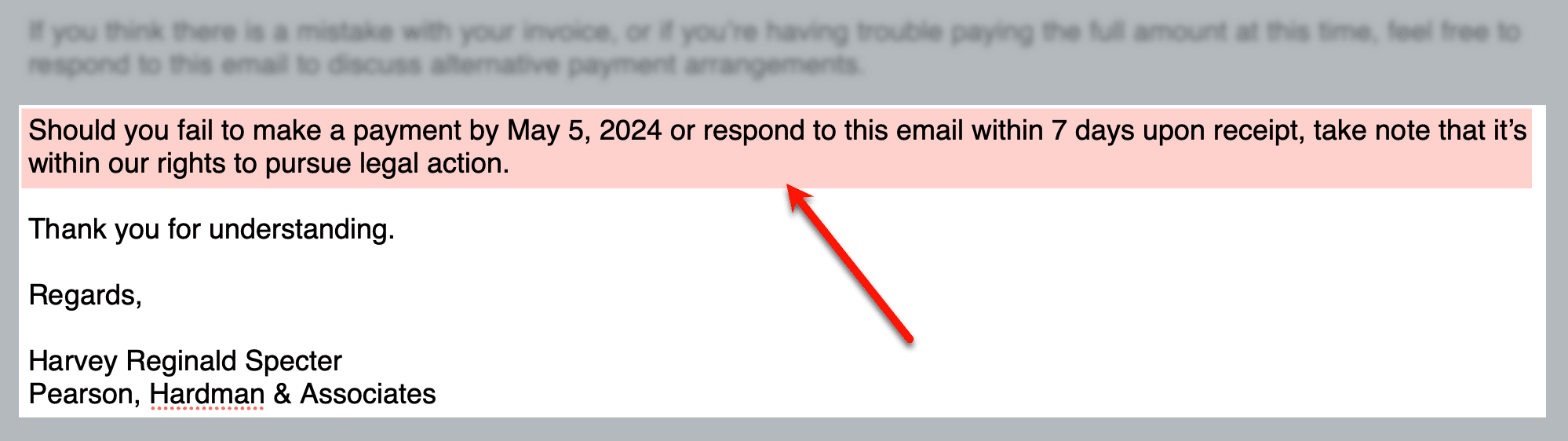

Should you fail to make a payment by [new deadline] or respond to this email within [X] days upon receipt, take note that it’s within our rights to pursue legal action.

Thank you for understanding.

Regards,

[Your name]

[Your firm’s name]

2. First Debt Collection Notice From Attorney

Prior to sending a letter with a warning of potential legal proceedings or involvement of a debt collector agency, you could send up to three debt collection letters or notices scheduled 30 days apart.

Your first debt collection letter should be nothing more than a gentle reminder.

Here’s what it can look like:

[Subhead details]

To [client],

Good day!

Thank you for choosing [your firm’s name] for your [case details].

I’m writing to inform you about your overdue invoice [invoice number], which was due on [original due date].

You might have forgotten to settle your outstanding balance, which amounts to [debt amount].

Please be reminded that our agreement includes an interest charge of [interest rate] every [X] days overdue. Thus, your new balance is [new amount owed], which is [debt amount] plus [interest charge] (X interest for X days).

You can send a check to our office or send the money to:

[Payment details]

Please settle your balance on or before [new deadline].

If you have any questions or would like to discuss alternate payment options, just send an email to [your email address] or call [phone number].

Very truly yours,

[Your name]

[Your firm’s name]

3. Second Debt Collection Letter From Attorney (Provision For Incremental Payments)

The second letter is primarily a follow-up. If you’re writing this, chances are your client is unable to pay the full amount or is intentionally avoiding payment.

It’s also possible that the client missed the first letter entirely.

Regardless, this is where you can put forward alternative payment suggestions.

[Subhead details]

Dear [client],

I hope this letter finds you well.

You may have missed our first letter, which mentioned your unpaid balance of [amount owed] due last [original due date].

If you’re unable to pay the full amount, let us know so we can huddle together in creating a repayment plan that works for you. You can reply to this letter or call [phone number] to proceed.

Attached is a copy of your invoice for viewing. Take note that we also accept payments via credit card — just follow this link [attach link to payment portal] to get started.

Again, please be reminded that our agreement includes an interest charge for payments over [X] days late. Please respond to this letter within [X] days or make the full payment before [deadline] to avoid accruing interest charges.

Thank you for your time,

[Your name]

[Your firm’s name]

4. Third Debt Collection Notice From Attorney

If the client still hasn’t paid after the second letter, you can send a third quick message.

[Subhead details]

Dear [client],

This letter is to remind you that your outstanding balance amounting to [amount owed], due last [original due date], is still unpaid as of [current date].

As of writing, the payment is now [X] days overdue.

Please contact us at [phone number] to discuss your payment status. You can also respond to this email if you have questions or other concerns.

We also want to inform you that our firm is ready to initiate legal proceedings if we don’t receive a response within [X] days — or full payment on or before [new deadline].

You can send your payment to:

[Payment details]

We are here to help. If you’d like to discuss alternate payment options, don’t hesitate to reach out.

Again, thank you for choosing [your firm’s name] for your case.

Regards,

[Your name]

[Your firm’s name]

Final Thoughts

Creating a debt collection attorney is just one part of growing a law firm. You should also focus on your law firm marketing efforts to win more business and build a brand that clients can trust. Contact us and we’ll prepare a custom marketing plan for your firm.

Table of Contents

Related Articles

Dominate Your Market with Digital Marketing Services That Deliver

Talk to a certified professional today, and we will design a strategy specific to your case.